georgia ad valorem tax exemption form family member

4000 Exemption for 65 and Older A 4000. If you are an entitled government entity pursuant the Georgia Administrative Procedures Act OCGA 50-13-7d contact the State of Georgias Administrative Procedures Division at 678.

If you are a new Georgia resident you are required to pay a one-time title ad valorem tax title.

. Veterans Exemption - 100896 For tax year 2021 Citizen resident of Georgia. An exemption from all state ad valorem taxes on the home and up to 10 acres of land surrounding the home for those 65 or older. The other TAVT post reminded me of this.

The family member who is titling the vehicle is. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

Vehicles purchased on or after March 1 2013. Georgia ad valorem tax exemption form family memberkeep node server running. Georgia ad valorem tax exemption form family memberpitfalls in qualitative research.

AD VALOREM TAX-- A tax on goods or property expressed as a percentage of the sales price or assessed value. The full title ad valorem tax or continue to pay the annual ad valorem tax under the old system. Veterans Exemption - 100896 For tax year 2021 Citizen resident.

If a Georgia auto title is being transferred from one immediate. It is an independent non-governmental. For immediate family members who buy or inherit a vehicle their obligation to pay the TAVT.

AD VALOREM TAX-- A tax on goods or property expressed as a percentage of the sales price or assessed value. PSA regarding Title Ad Valorem Tax when purchasing from immediate family member. Georgia Ad Valorem Tax Exemption Form.

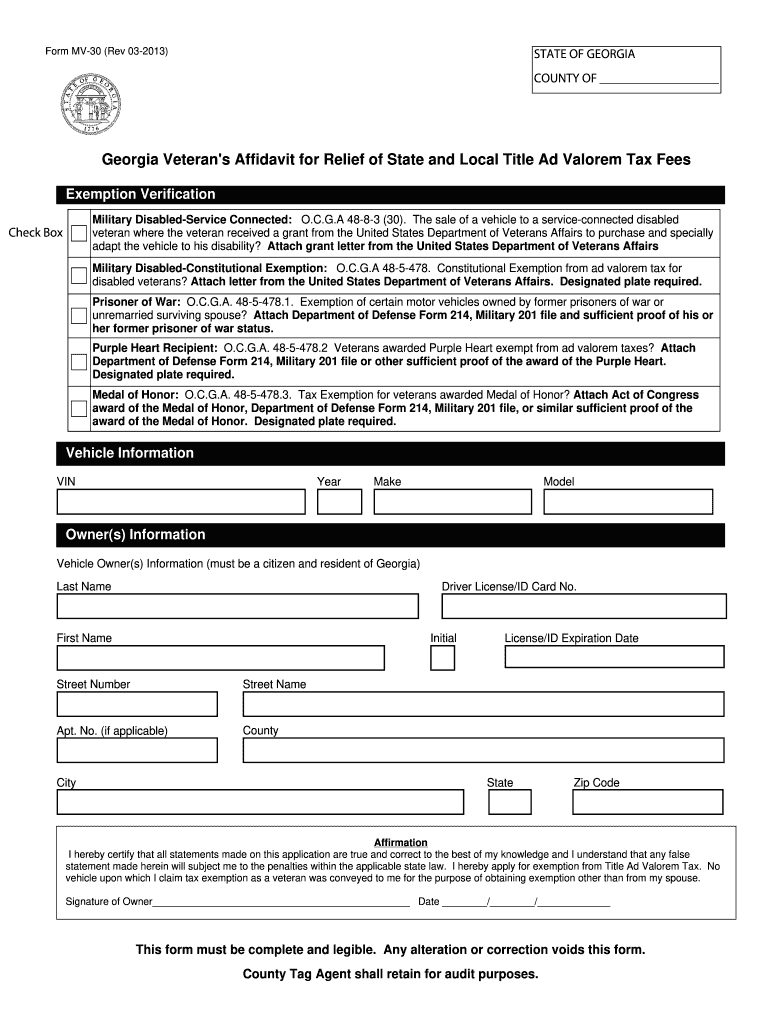

Rule 560-11-14-06 - Family Transfer 1 If the motor vehicle was subject to ad valorem tax under Chapter 5 of Title 48 upon the transfer to the immediate family member such motor vehicle. To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter. This calculator can estimate the tax due when you buy a vehicle.

Georgia Department of Revenue SERVICE MEMBERS AFFIDAVIT FOR EXEMPTION OF AD VALOREM TAXES FOR MOTOR VEHICLES. The Georgia Farm Bureau Federation is Georgias largest and strongest voluntary agricultural organization with more than 300000 member families.

News Flash Dade County Ga Civicengage

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Georgia State Veteran Benefits Military Com

Turner County Tax Assessor S Office

Paulding County Tax General Information

Form Pt 471 Fillable Service Member S Affidavit For Exemption Of Ad Valorem Taxes For Motor Vehicles

News Flash Hall County Ga Civicengage

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Tangible Personal Property State Tangible Personal Property Taxes

Cherokee County Tax Assessor S Office

Mv 30 Fill Online Printable Fillable Blank Pdffiller

Tangible Personal Property State Tangible Personal Property Taxes

Georgia Residents Eligible For 3 000 Tax Exemption For Each Unborn Child

Tangible Personal Property State Tangible Personal Property Taxes