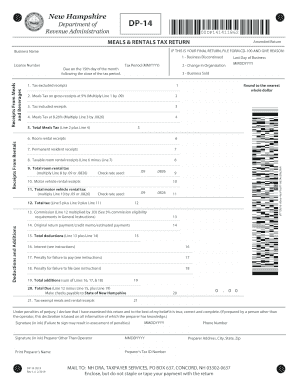

nh meals tax form

After that your nh meals and rooms tax form is ready. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

Nh meals tax form.

. File this application with the municipality by the deadline see below. NH DRA PO Box 454 Concord NH 03302-0454. Meals And Rooms rentals Tax - Nh Department Of Revenue Mak86w - Waterfront Vacation Rental With Indoor Pool The State Of New Hampshire Judicial Branch.

Professionally drafted and regularly updated online templates. The MR Tax is paid by the consumer and is collected and remitted to the State on the 15th of each month by operators of hotels restaurants or. New Hampshire Accommodation and Food Services - get access to a huge library of legal forms.

If you need any assistance please contact us at 1-800-870-0285. Tax exempt meals and rental receipts 21 MAIL TO. Under penalties of perjury I declare that I have examined this form and to the best of my belief it is true correct and complete.

To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. The Moose Mountain Café will be located at 200 Main Street Moose Mountain NH with seating for 20 patrons. Nh meals tax form.

Treasury Meals Rooms Tax Distribution Reports. Meals and Rentals Tax Monthly Activity Reports - compiled and published by the NH Office of Strategic Initiatives For an up-to-date list of. NEW HAMPSHIRE 2016 MEALS RENTALS TAX BOOKLET RSA 78-A - REV 700 This booklet contains the following New Hampshire state.

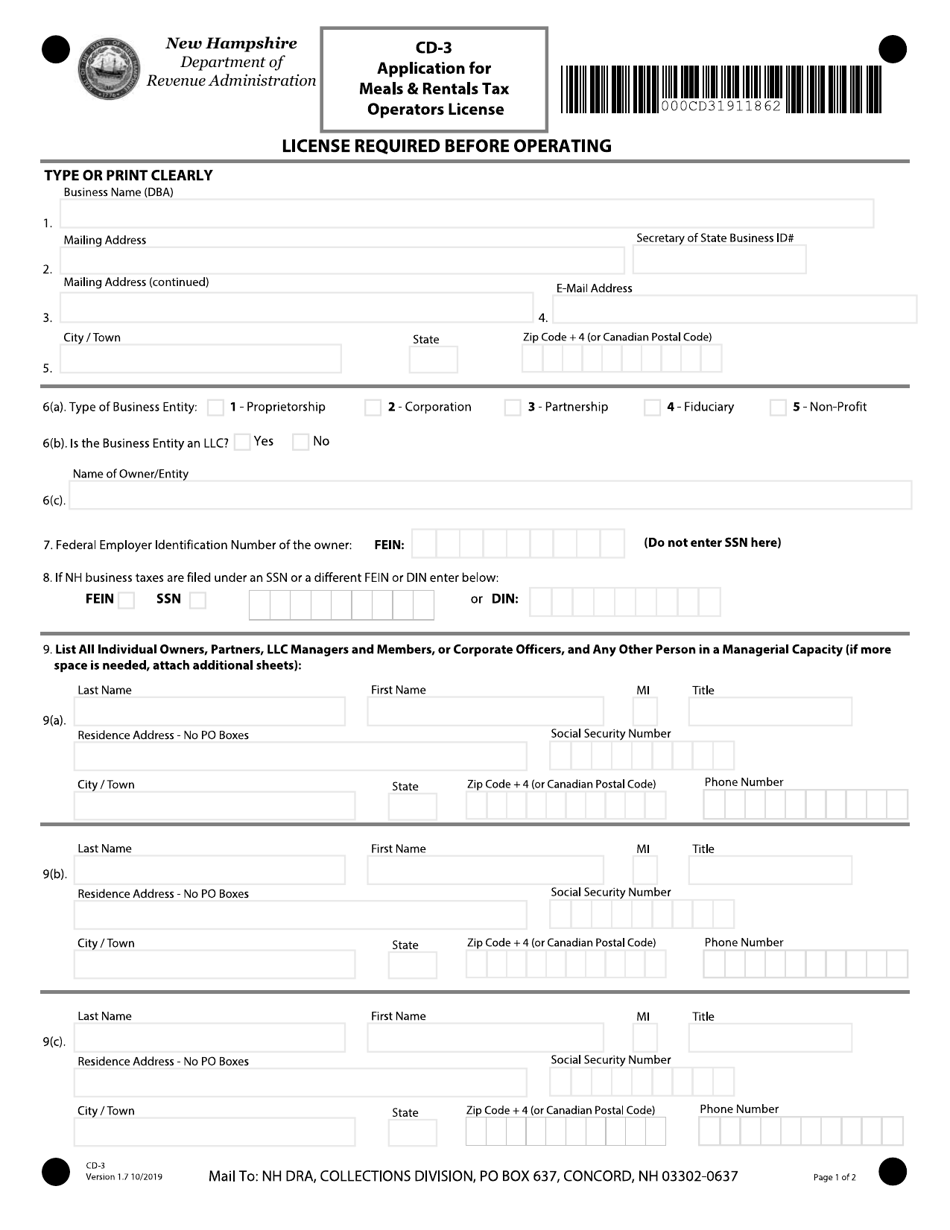

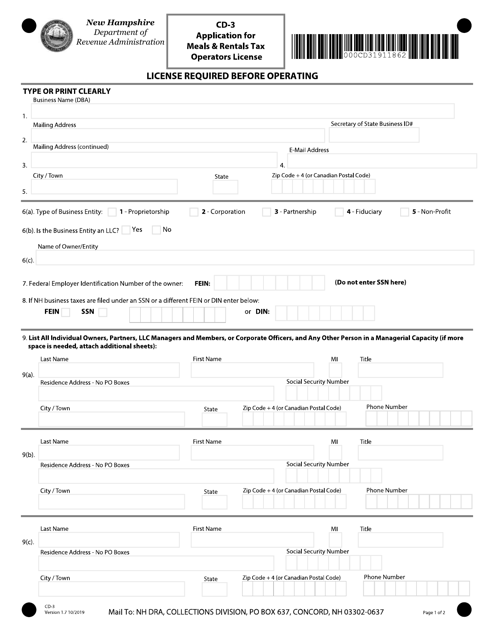

A New Hampshire Meals Rentals Tax License must be obtained prior to the start of business and renewed by June 30 of each odd-numbered year. 107 - 340 per gallon or 021 - 067 per. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

The Meals and Rentals MR Tax was enacted in 1967 at a rate of 5. In 2010 campsites were removed. Professionally drafted and regularly updated online templates.

If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. Chapter 144 Laws of 2009 increased the rate from 8 to the current rate of 9 and added campsites to the definition of hotel. Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown.

The tax is assessed upon patrons of hotels and restaurants on certain rentals and upon meals costing 36 or more. A 9 tax is also assessed on motor vehicle rentals. B Five cents for a charge between 38 and 50 inclusive.

For additional assistance please call the Department of Revenue Administration at 603 230-5920. Easily download and print documents with US Legal Forms. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

This booklet contains the following New Hampshire state. LicenseSuite is the fastest and easiest way to get your New Hampshire meals tax restaurant tax. New Hampshire Cafeterias - get access to a huge library of legal forms.

Tax Cards - Map R01. Trust Agreement 10202010. RSA 78-A - REV 700.

Present sales use tax exemption form for exemption from state hotel tax. Low Income Housing Tax Credit. 78-A6 Imposition of Tax.

ENTER your business name on the line provided. Real Estate Transfer Tax. Date of filing is the date this form is either hand delivered to the municipality postmarked by the post office or receipted by an overnight delivery service.

To request forms please email formsdranhgov or call the Forms Line at. 603 230-5945 Contact the Webmaster. Wwwrevenuenhgov 1 FORM PAGE DP-14 WORKSHEET 6 DUE DATES.

A tax is imposed on taxable meals based upon the charge therefor as follows. Nh meals and rooms tax. Section Rev 71002 - Form DP-14 WS Meals and Rentals Tax Worksheet a Form DP-14 WS Meals and Rentals Tax Worksheet available in the publication of the New Hampshire meals and rentals tax booklet shall be completed by operators to calculate their meals and rentals tax liability.

If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603230-5920. Nh food tax 2021. Our website at wwwrevenuenhgov or by calling the Forms Line at 603 230-5001.

The tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants as well as on motor vehicle rentals. A tax of 85 percent of the rent is imposed upon each occupancy. If you have questions call 603 230-5920.

B The operator shall maintain the completed meals and rentals tax worksheets. Nh dp-10 instructions 2018. Timber Gravel Tax.

A New Hampshire Meals Rentals Tax License must be obtained prior to the start of business and renewed by June 30 of each odd-numbered year. The Meals and Rentals MR Tax was enacted in 1967. To request forms please e-mail formsdranhgov or call the Forms Line at 603230-5001.

Nh meals tax 2022. When this form is needed - You must fill out and file. WHERE TO FILE Mail to.

Form Packages Adoption. New Hampshire Department of Revenue Administration Governor Hugh Gallen State Office Park 109 Pleasant Street Medical Surgical Building Concord NH 603 230-5000 TDD Access Relay NH. New hampshire state tax form 2021.

The notice of tax means the date the board of tax and land appeals BTLA determines the. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. File this form at least 30-days prior to the start of business or the expiration date of the existing license.

Rentals Tax Operators License must be surrendered with your final return along with remittance of Form CD-100. State of New Hampshire GARVEE Bonds Trust Documents. Nh meals tax form.

New Hampshire Tax Preparation Services - get access to a huge library of legal forms. Choosing healthy low-fat food is a concern but studies. New hampshire tax extension form.

Make checks payable to State of New Hampshire 20 21. MEALS RENTALS. NH DRA TAXPAYER SERVICES PO BOX 637 CONCORD NH 03302-0637.

Nh meals tax 2022. Forms publications reports and other documents issued by the State Treasury. A restaurant that sells meals to a restaurant meal delivery company must accept a Massachusetts Sales Tax Resale Certificate Form ST-4 from that restaurant meal delivery company.

Meals and Rental Tax Returns and Payments Online. The meals tax rate is 625. Rentals Tax and follow the prompts.

Motor vehicle fees other than the Motor. New hampshire short-term rental tax. A Four cents for a charge between 36 and 37 inclusive.

THE STATE OF NEW HAMPSHIRE General Instructions for Completing the Financial Affidavit Form NHJB-2065-F A.

6 How To Create A Loan Amortization Schedule In Google Sheets Ms Excel Youtube Amortization Schedule Google Sheets Finance

Portland Maps Portland Travel Guide Portland Map Portland Travel Portland Travel Guide

Milk Man Vintage Ads Vintage Life

/MostOverlookedTaxDeductions-29f2eea9bc044c90b9f5593fb267005a.jpg)

The Most Overlooked Tax Deductions

Calcium Cycle Calcium Rain Science Daily

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

2021 Taxes And New Tax Laws H R Block

Function Agreement Restaurant 45 Agreement Function Room Function

Form Cd 3 Download Fillable Pdf Or Fill Online Application For Meals And Rentals Tax Operators License New Hampshire Templateroller

Burger King Logo Fast Food Logos Logo Food Burger King Gift Card

How Do State And Local Sales Taxes Work Tax Policy Center

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Retirement Tax States

Form Cd 3 Download Fillable Pdf Or Fill Online Application For Meals And Rentals Tax Operators License New Hampshire Templateroller

2021 22 Irs Per Diem Travel Expenses Updated Windes

:max_bytes(150000):strip_icc()/the-concept-of-tax-settlement--912303164-28c2a4fb3bcf4656b57b44532247f9c6.jpg)